Tmall and JD.com are China’s leading e-commerce platforms. These are the places where Chinese consumers go to shop – and where more than 80% of online transactions occur.

Tmall and JD get significant traffic. Naturally, inside these marketplaces — i.e., the bottom of the marketing funnel — is where you’re going to see the greatest ROI on your spending. That’s why brands often allocate most of their marketing budget to these platforms in year one of their market entry – as they look to initiate some momentum with sales.

Brand campaigns see the highest ROAS, but you’ll want to run campaigns for both brand and product (more on brand vs product campaigns below).

In-platform advertising on e-commerce platforms is where you’ll get the greatest ROI, but there is also a finite amount of what you can eat up.

Campaigns will eventually reach peak performance before returns start diminishing, so you need to know when to cut off any additional spending. After that, you’ll need to look outside the platforms.

Brand vs product campaigns

Chinese consumers search for products differently. A lot of categories in China are branded — i.e. consumers are searching for brand names rather than by category or product names. That’s particularly true for many FMCG categories on Tmall and JD, and why brands often need to pursue an omni-channel approach to really drive awareness and sales.

Before you activate any digital marketing in China, make sure you understand how consumers behave in your category.

Search in China

Baidu is China’s leading search engine – controlling around 80% of China’s online search market. When it comes to searches with purchase intent, however, Chinese consumers typically aren’t making those on Baidu. They head to Tmall or JD.com instead.

That said, those at an early stage of their buying journey are more likely to search for more information and reviews, before making a decision. That’s particularly true when it comes to buying complex products or services – like B2B buying, for instance.

Baidu can point to some e-commerce platforms, but it’s most often used for driving traffic back to a .CN website.

Baidu can also be indexed to deduce large amounts of information about the Chinese market.

Social media in China

Chinese consumers cannot keep their phones out of their hands. Social media is central to people’s daily lives, and where the country’s 900 million internet users spend most of their time online.

Chinese social media is dynamic and diverse. Consumers frequent a multitude of apps, multiple times a day. It’s a far more complex landscape than it is in the West.

With 1.2 billion daily active users, WeChat is one of the world’s largest apps. It’s used for messaging, calling, photo and video sharing, shopping, banking, mobile payments, dating, and much, much more.

Douyin, China’s version of TikTok, has 650 million daily active users and saw e-commerce transactions triple to $77 billion USD in GMV, in 2020. And Pinduoduo, a social commerce app, saw its user base grow by a whopping 50% last year.

Brands in most categories will want to establish a presence on WeChat. As one of the world’s most active apps, it’s a key brand awareness channel – with a growing e-commerce offering.

To know which other Chinese social apps your brand should be prioritizing, you’ll need to understand where users in your category are spending their time online. For consumer brands in categories like cosmetics, that’s going to include channels like Little Red Book (Xiaohongshu), Douyin (China’s TikTok), Weibo, and Bilibili.

Chinese social media presents an enormous opportunity for brands looking to build customer loyalty and drive repeat purchases. That’s because China’s e-commerce platforms operate on a pay-to-play basis. Even if a customer has purchased from you before, you’ll need to spend on advertising to appear in their search results again.

Chinese social media, on the other hand, enables you to build highly engaged communities that belong to your brand.

That said, it’s also a highly competitive space. If you’re to steal consumers’ attention away from your competition, then you’ll need to get creative and stand out (we can help).

KOLs and micro-KOLs

Influencers are a driving force behind digital marketing in China.

Known locally as KOLs (Key Opinion Leaders), Chinese influencers have the ability to make products trend quickly and can drive purchases through the roof.

In a recent Chinese consumer survey conducted by Rakuten Insight, about 81% of respondents who had followed one or more influencers on social media said that they had purchased the products endorsed by them.

There’s almost no limit to the amount of money you can spend on KOLs. Some of China’s top influencers will charge thousands of dollars for a fragment of their time. But you’re ultimately paying for their following.

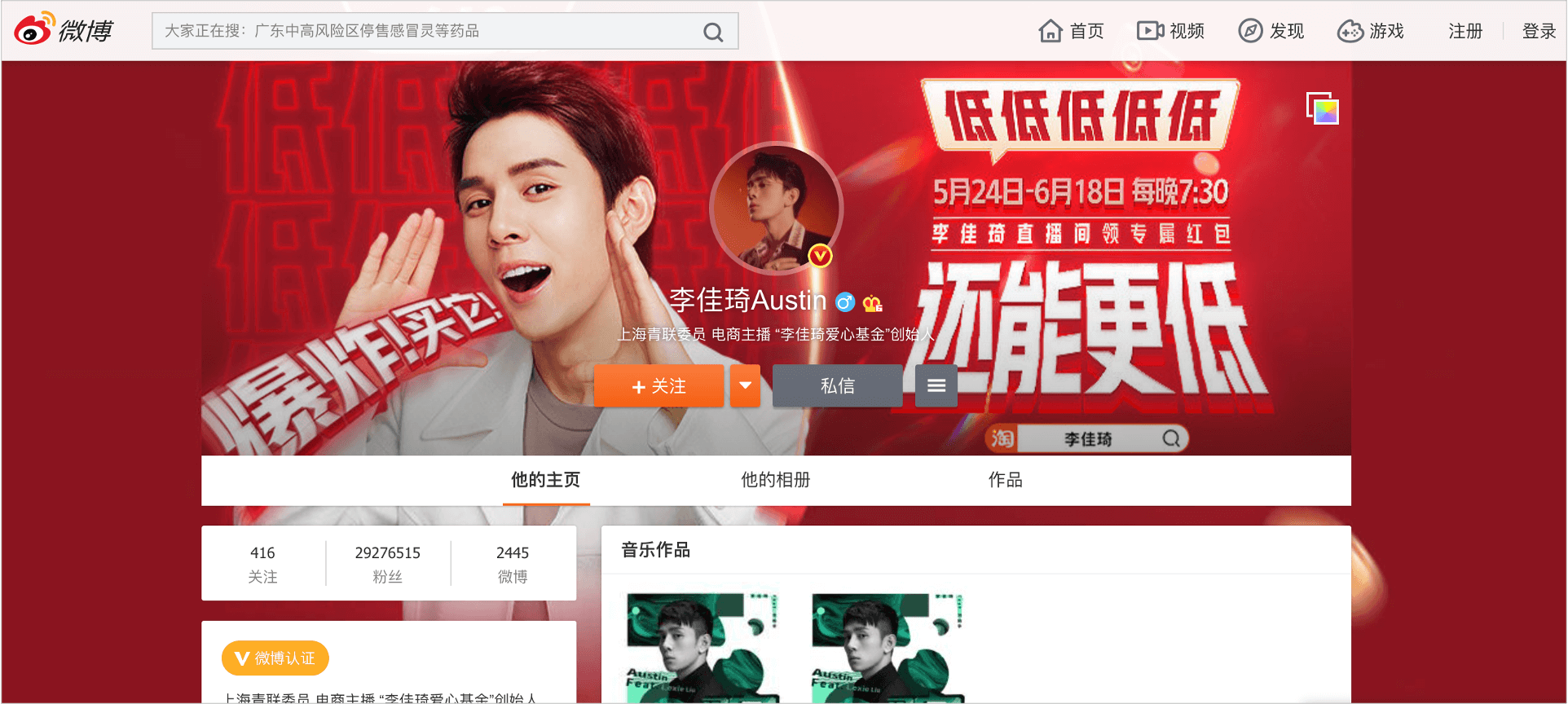

Austin Li — known as “The Lipstick King” for once selling 15,000 lipsticks on Taobao in five minutes — has over 45 million fans on Douyin. Viya, another top KOL, has amassed over 38 million followers on Taobao and has managed to draw in over 37 million viewers to a single livestream.

Most brands could only dream of such reach, and the association between your brand and a top KOL can keep consumers purchasing your product long after a campaign has ended.

Though there can also be drawbacks to using leading KOLs in China. For one, many top KOLs will require your product to be heavily discounted for livestreams — sometimes by as much as 75%. That can be harmful to margins and to driving repeat purchases.

You may also not be able to reuse any of the content that top KOLs push out through their own channels. Even though they’re promoting your product, if they’re doing so via their own social accounts, then you will often need authorization from them to use it.

Rather than splashing out on a top KOL for a single campaign, some brands use micro-influencers or even hired actors (who come at a fraction of the price).

A good China digital marketing agency will be able to advise on the best approach for your brand (get in touch).