The 2021 growth figures for social commerce were jaw-dropping—and in 2022 we expect this growth to accelerate further.

Although ByteDance does not disclose its e-commerce revenue, inside sources at the end of 2021 said that the company was aiming to exceed $150 billion USD in gross merchandise value (GMV) on Douyin for the year—a six-fold increase from 2020. For Douyin’s main short video competitor, Kuaishou, e-commerce GMV jumped 86.1% year-over-year, according to the firm’s latest financial results from Q3 2021. Meanwhile, transaction volume on WeChat’s mini programs, which encompasses both retail and digital services, is up 897% since 2019—with the number of overseas brands selling on mini programs up 268% in that time.

In comparison, Alibaba noted in its Q3 2021 financial results that the GMV of physical goods for the quarter had grown by single-digits year-over-year, in part due to “more players in the China e-commerce market”.

Despite the hype, these disparate growth stories have not caused a significant shakeup in the overall distribution of the e-commerce pie.

Alibaba is still the giant in the market, with a 58% share in retail e-commerce in 2021—down only slightly from 60% in 2020. The firm still has huge competitive advantages with the largest e-commerce user base, strong trust from users and merchants, the most popular livestreaming platform, as well as a robust logistics network. For foreign brands entering the China market, setting up a Tmall store is still the most important move for establishing a China e-commerce presence.

JD.com, the second largest player, has a 27% market share.

While the upstart platforms have surging GMV figures, they started from scratch and have only eked out single-digit market shares.

But these new entrants to e-commerce are poised to post major growth figures again in 2022—so this year we may see them take a larger share of the pie.

Key to the success of Douyin, Kuaishou, WeChat, and Xiaohongshu is that they are fundamentally social platforms that attract hundreds of millions of regular users for reasons other than just to shop. The newly developed e-commerce functions on these platforms offer users the option of making spontaneous, friction-less purchases without changing apps. Tencent-backed JD.com and Pinduoduo also benefit from this trend because they integrate with WeChat.

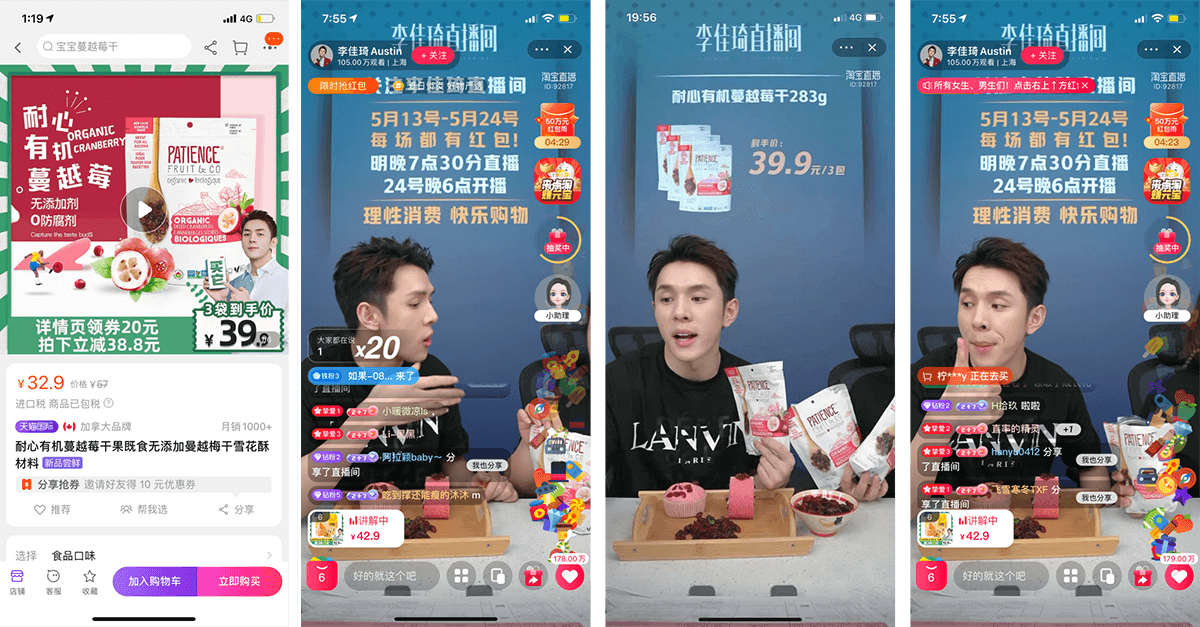

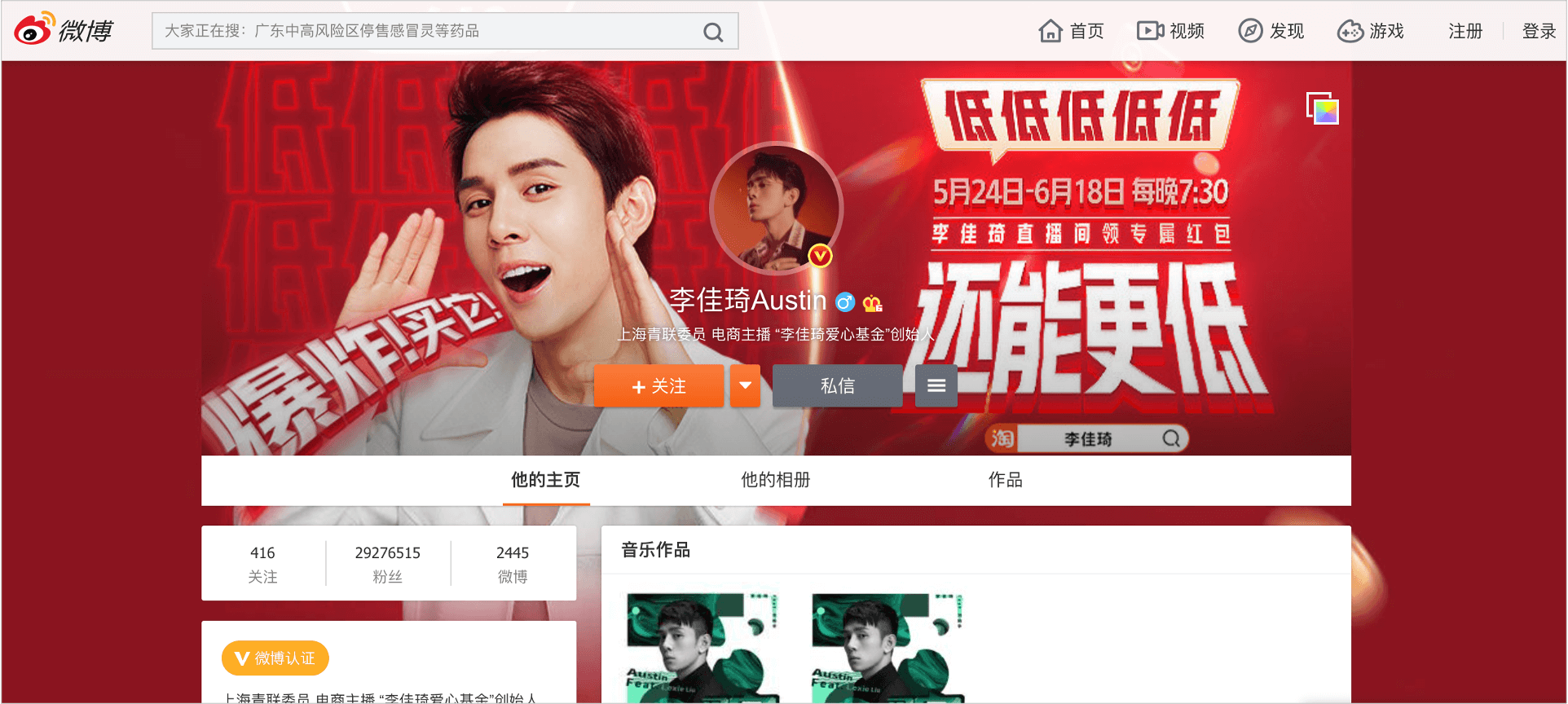

With the convenience and entertainment value offered by this new mode of online shopping, more and more Chinese consumers aren’t necessarily carrying out targeted product searches on traditional e-commerce marketplaces when they buy goods. Rather, they are making more spontaneous purchases as they browse content or chat with friends online.

For example, a young Chinese office worker watching short videos on Douyin for entertainment is exposed to advertisements and digital stores that are seamlessly integrated into the video feed—or are woven into user-generated videos themselves. That viewer can then purchase products immediately within the app.